Empower Your Business with Digital Factoring

Accelerate Your Cash Flow with Digital Factoring

Waiting 15, 30, or even more days for customer payments can slow down your business growth and create unnecessary financial strain. With FactR’s digital factoring solution, you no longer have to endure these delays. Instead of waiting for your customers to settle their invoices, you can “sell” your unpaid invoices through our platform and receive immediate access to cash. This allows your company to maintain a steady cash flow, cover expenses, and reinvest in growth opportunities—all without the stress of long payment cycles. FactR transforms your receivables into instant working capital, giving your business the financial flexibility it needs to thrive.

With FactR’s completely online platform, managing your company’s financing has never been easier. Our seamless digital process ensures that funding is quick, straightforward, and accessible from anywhere—whether you’re in the office, at home, or on the go. Say goodbye to complex paperwork and time-consuming procedures. With just a few clicks, you can access the funds your business needs anytime, ensuring uninterrupted cash flow and financial flexibility whenever you need it.

At FactR, we believe in providing a factoring service that is both cost-effective and completely transparent. Our pricing is tailored to fit your company’s unique financial needs, ensuring you only pay for what you use—no hidden charges or unexpected fees. Whether you need to factor a single invoice or multiple transactions, our platform offers clear, upfront cost breakdowns so you always know exactly what to expect. Experience financial flexibility with full transparency, allowing you to make informed decisions with confidence.

At FactR, we put you in control of your financing. After a quick and free registration, our experts provide personalized financial guidance to help you make the best decisions for your business. You can request a tailored offer at any time, with no pressure or commitment. Once you sign the contract, you retain complete flexibility—deciding when and how much you want to factor, based on your company’s needs. With no long-term obligations, you can access funding only when it benefits you, ensuring financial freedom and adaptability for your business growth.

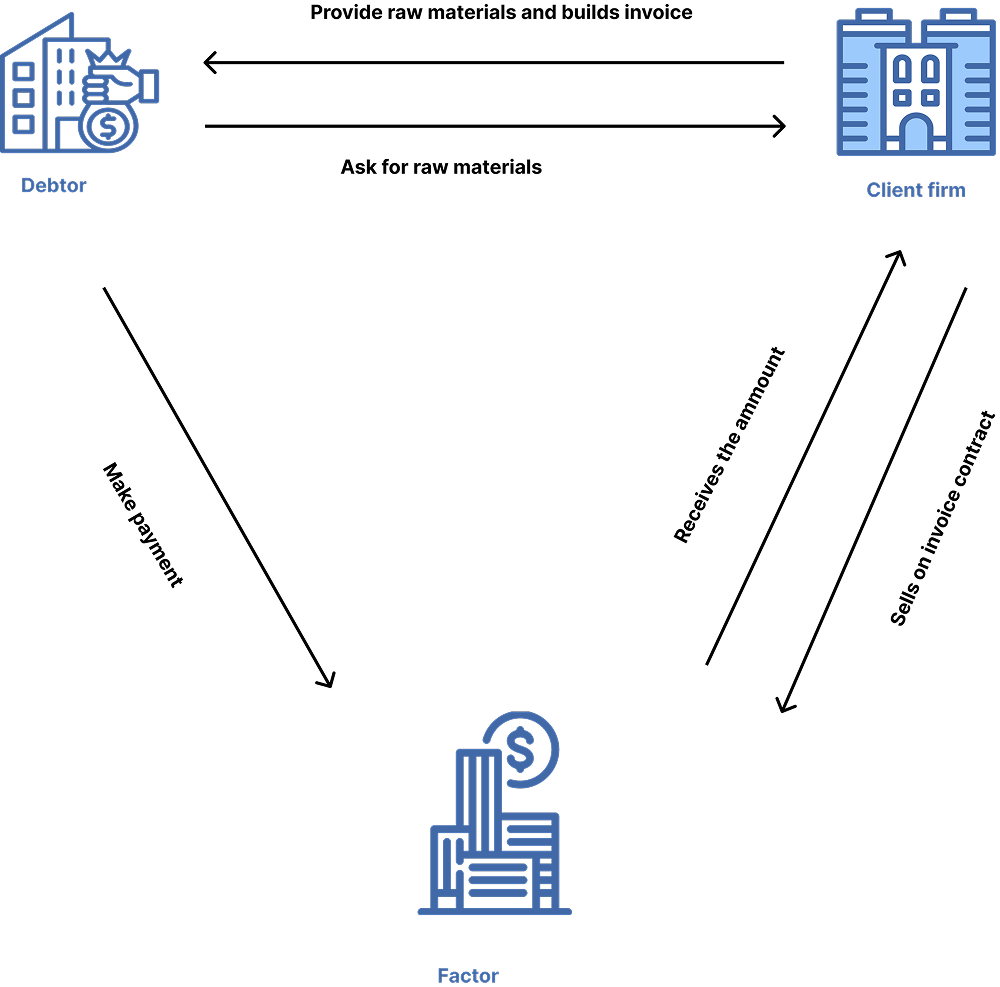

How it works

We promise to give you an excellent experience

1

Getting started is quick, easy, and completely free. In just a few minutes, you can complete a simple registration process by answering a few essential questions and verifying your identity. Once registered, you can conveniently upload your company’s documents along with the invoices you wish to factor. Our streamlined platform ensures a smooth experience, allowing you to access funding without unnecessary delays or paperwork.

2

FactR’s advanced algorithms analyze your financial data to assess your company’s needs. Based on this evaluation, we generate a customized offer along with a tailored funding plan designed to support your business’s growth. This data-driven approach ensures you receive the most suitable financing solution quickly and efficiently.

3

In the next step, we confirm the authenticity of the submitted invoice. If required, we also reach out to your customer to ensure all details are accurate and valid before proceeding with the funding process.

4

Once your invoice is verified and you approve our offer, we finalize the contract. Following this step, the agreed-upon funds—typically 80-90% of the invoice value, including VAT—are transferred directly to your company’s account, ensuring swift access to the capital you need.

5

When the payment term expires, your customer remits the invoice amount to our financial partner. At this stage, we release the remaining 10-20% of the invoice value, including VAT, and transfer it directly to your company’s account, completing the transaction.

Get in touch

address - 1139 Budapest, Gömb utca 48/D IV 6

info@factr.online

Phone : +36300000000

Follow our social media

Receive Your Personalised Offer Today!

Who Can Benefit from Digital Factoring?

Digital factoring is an ideal solution for businesses that meet the following criteria:

1

2

3

4

5

6